Open the Advantages of Using a Home Loan Calculator for Your Following Home Acquisition

Open the Advantages of Using a Home Loan Calculator for Your Following Home Acquisition

Blog Article

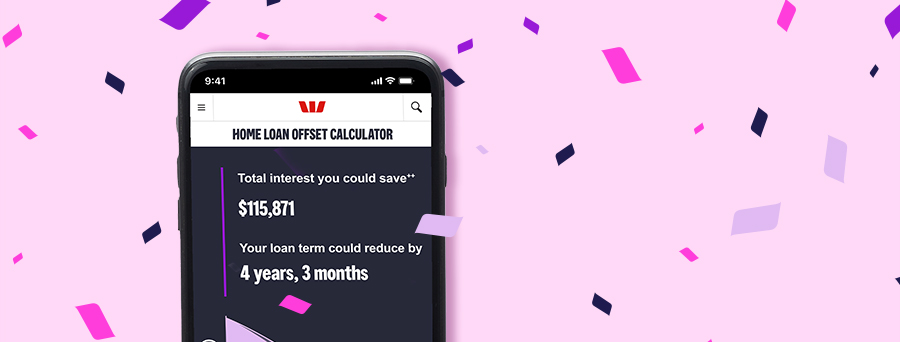

Advanced Finance Calculator System: Enhancing Your Lending Administration Experience

Think of having a tool at your disposal that not only computes lending details yet likewise gives a thorough break down of your financial commitments. Get In the Advanced Lending Calculator System, an advanced service developed to elevate your finance monitoring experience to brand-new elevations.

Benefits of Making Use Of the System

One key benefit is the system's capability to provide accurate and instant estimations for different kinds of loans, consisting of home mortgages, vehicle fundings, and personal fundings. Individuals can input different variables such as financing amount, interest price, and car loan term to swiftly establish monthly settlements and overall rate of interest over the life of the funding.

Additionally, the boosted system integrates interactive functions such as graphs and amortization routines, enabling users to visualize just how their payments will progress in time and comprehend the break down of principal and rate of interest. These aesthetic aids improve individuals' understanding of complex monetary principles and encourage them to make sound monetary choices. Furthermore, the system's user-friendly interface makes it available to people with varying degrees of financial literacy, advertising financial education and empowerment.

Key Includes Review

What special capabilities identify the improved Lending Calculator System from conventional monetary tools? The innovative Loan Calculator System uses a range of crucial attributes that set it apart in the world of financing administration devices. In addition, the system consists of a detailed payment schedule that outlines principal and passion repayments over the life of the car loan, aiding users in understanding their economic commitments.

Customizable Settlement Alternatives

Through the personalized payment alternatives, users can experiment with various circumstances to establish the most suitable settlement plan for their particular demands. Whether individuals prefer a much shorter financing term with higher monthly repayments to reduce overall passion or go with an extensive settlement timetable to decrease the monthly monetary concern, the Car loan Calculator System empowers users to make enlightened decisions.

Additionally, the ability to tailor payment options fosters economic responsibility and empowerment amongst debtors. By obtaining exposure into how various settlement methods affect their general finance terms, users can effectively manage their finances and job in the direction of achieving their lasting monetary purposes.

Financial Obligation Breakdown

Comprehending the breakdown of economic obligations is vital for customers to successfully handle their repayment strategies. By having a clear understanding of where their money is going, debtors can make informed choices and remain on the right track with their economic commitments. The monetary obligation breakdown normally includes the major quantity obtained, the rate of interest accumulated over the payment period, any type of added costs or costs, and the total settlement amount. This breakdown assists debtors see exactly how much of each settlement goes towards paying off the primary balance and just how much is alloted to passion and other expenses.

Having an in-depth monetary commitment malfunction offered by a sophisticated loan calculator system can encourage debtors to spending plan effectively and prioritize their repayments. It enables consumers have a peek at this website to visualize the impact of different repayment approaches, such as making additional settlements towards the principal or adjusting the finance Get the facts term. With this info at their fingertips, customers can take control of their economic commitments and job in the direction of accomplishing their settlement objectives effectively.

Comparison and Tracking Capabilities

Additionally, tracking abilities make it possible for customers to monitor their repayment progression gradually. They can conveniently track the continuing to be equilibrium, settlement background, and general lending status, enabling much better financial planning and administration. The system's ability to create thorough reports and visual depictions of the payment timetable additional aids debtors in understanding the impact of different circumstances on their monetary health.

In significance, the comparison and tracking abilities incorporated right into the car loan calculator system offer customers with beneficial understandings and openness, promoting accountable borrowing and effective finance monitoring.

Final Thought

Finally, the sophisticated finance calculator system uses various advantages for handling finances properly. home loan calculator. With personalized repayment options, thorough financial responsibility failure, and contrast and tracking capacities, customers can make educated decisions about their loans. This system boosts the overall financing administration experience by providing thorough tools and attributes to aid people better comprehend and handle their financial obligations

Go Into the Advanced Funding Calculator System, an advanced remedy created to boost your lending management experience to new heights. One crucial advantage is the system's capability to give instant and exact estimations for various kinds of financings, including mortgages, car lendings, and individual financings. Individuals can input various variables such as loan amount, interest price, and funding term to quickly figure out month-to-month payments and complete rate of interest over the life of the finance. The advanced Financing Calculator System uses an array of essential attributes that set it apart in the world of car Resources loan administration devices.In verdict, the advanced car loan calculator system provides various benefits for managing loans efficiently.

Report this page